How Are Tariffs Affecting Heartland Businesses? We Asked Them.

A new survey from the Trade War Lab and colleagues finds widespread harm and limited pushback among Kansas City and St. Louis area firms.

The second Trump administration has accelerated the United States’ shift towards trade protectionism that began in his first term. As of December 2025, the average U.S tariff rate has soared from 1.5% in 2022 to 17%. The Trade War Lab, in conjunction with the researchers at the UT Austin and the University of South Carolina, has collaborated with the World Trade Centers in Kansas City (WTC-KC) and St. Louis (WTC-STL) to better understand how Kansas and Missouri businesses view the current trade environment. This research surveys business managers to ascertain how tariffs have impacted their operations, which tariffs have proven to be especially concerning, how businesses plan to respond, and if firms have taken any political action in opposition to/ support of tariffs.

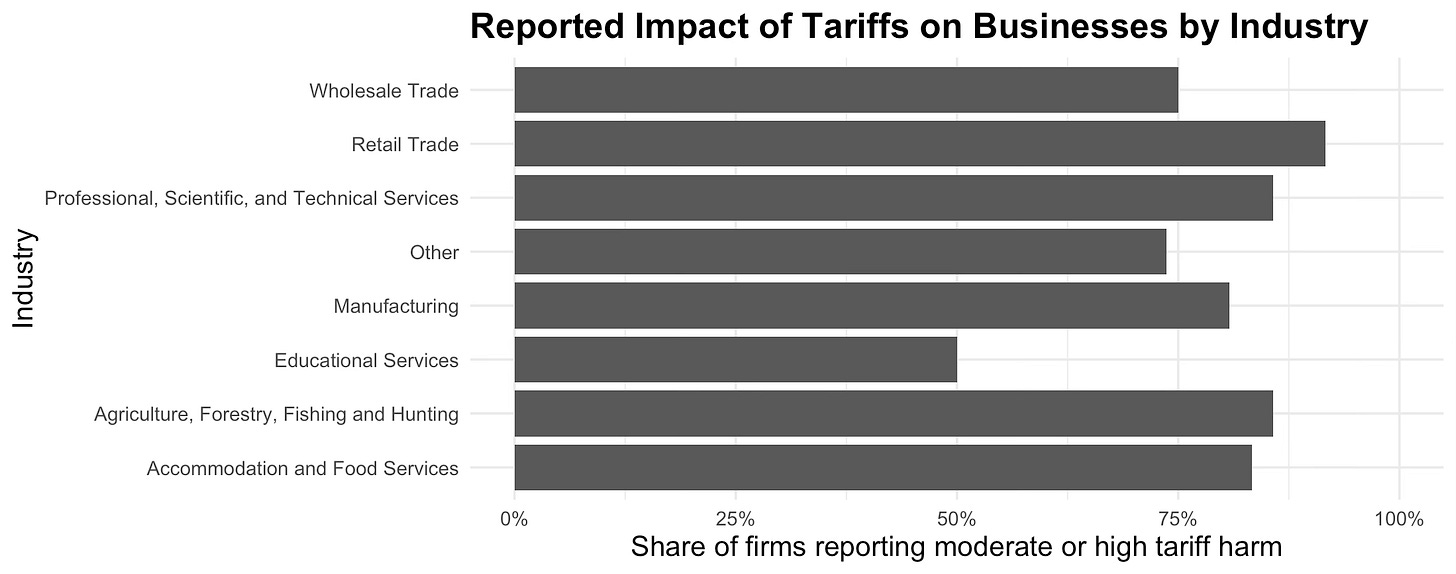

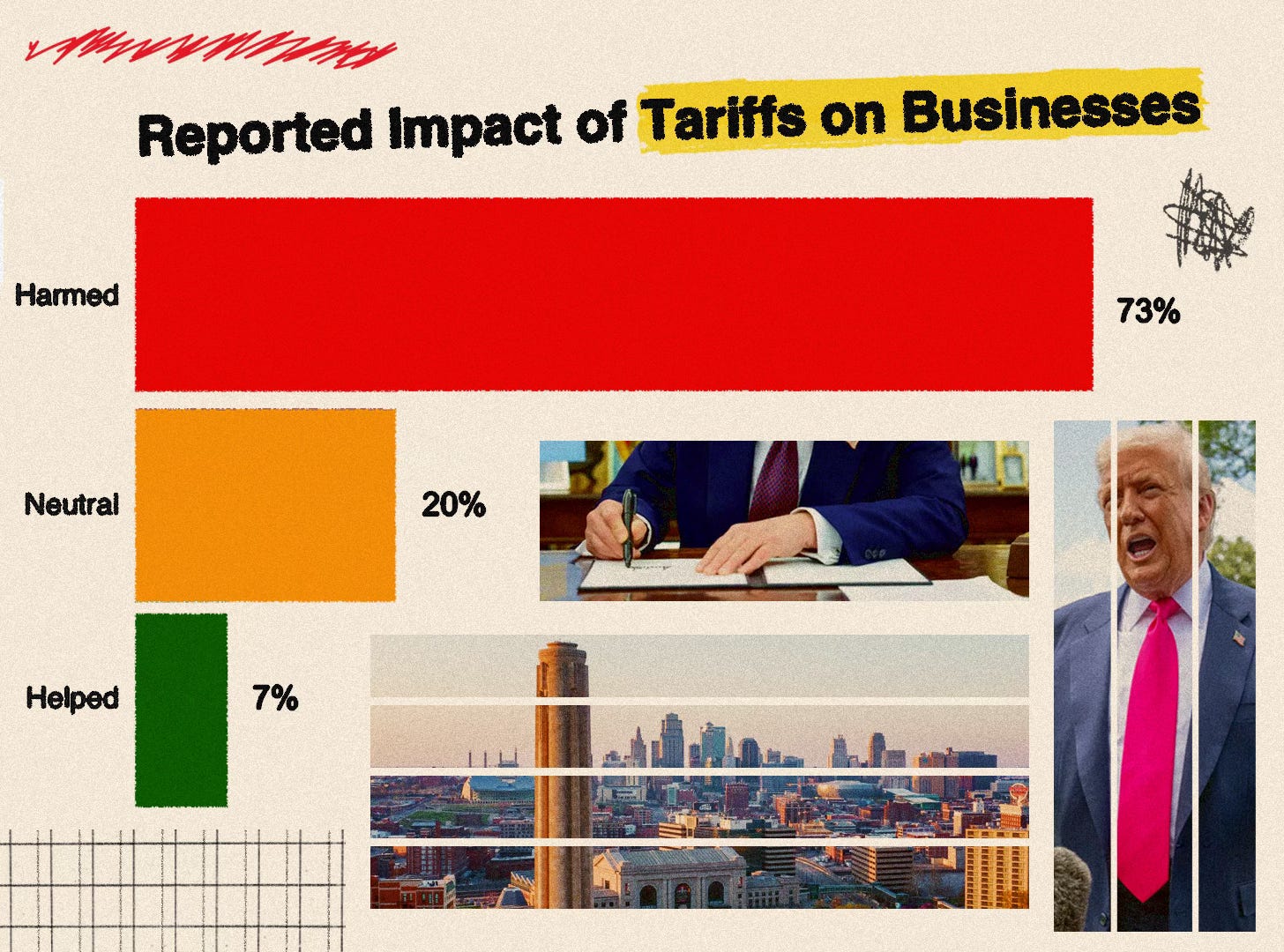

Preliminary results show that tariff pressure is widespread across industries in Kansas and Missouri. Overall, 73% of firms report being harmed by tariffs, while only 7% say tariffs have been beneficial to their business. On the industry level, 90% of retail trade firms reported moderate or high harm to their business because of tariffs. Firms in agriculture, forestry, fishing, and hunting as well as professional, scientific, and technical services follow closely, with approximately 86% of firms in each industry reporting harm.

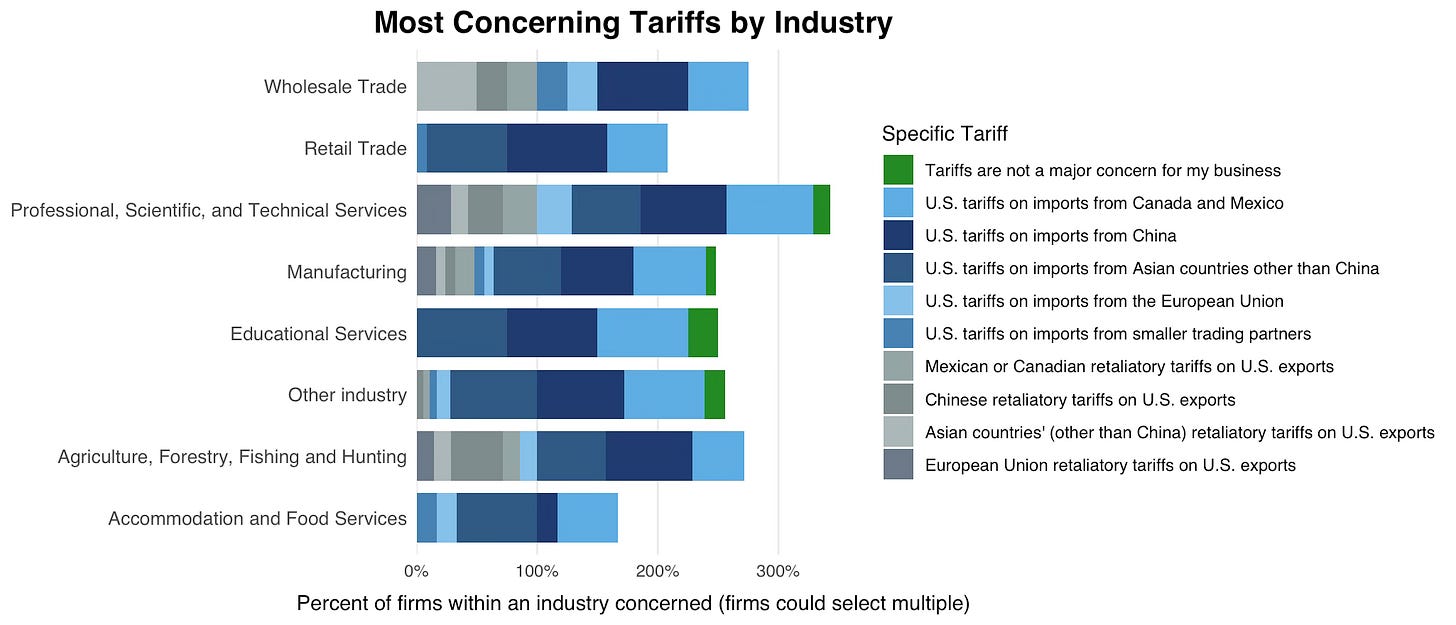

Figure 3 shows that import tariffs (in shades of blue) appear to be causing the most disruption for companies in the Kansas City and St Louis areas. A significant percentage of companies across all industries report meaningful concerns about tariffs on imports from China, other Asian countries, and the European Union. Retaliatory tariffs (in shades of gray) pose the most significant concern in the wholesale, agricultural, professional services, and manufacturing industries. Kansas and Missouri’s agricultural industries – the main driver the two state’s economies – are particularly exposed to Chinese retailiations restricting American soybean exports.

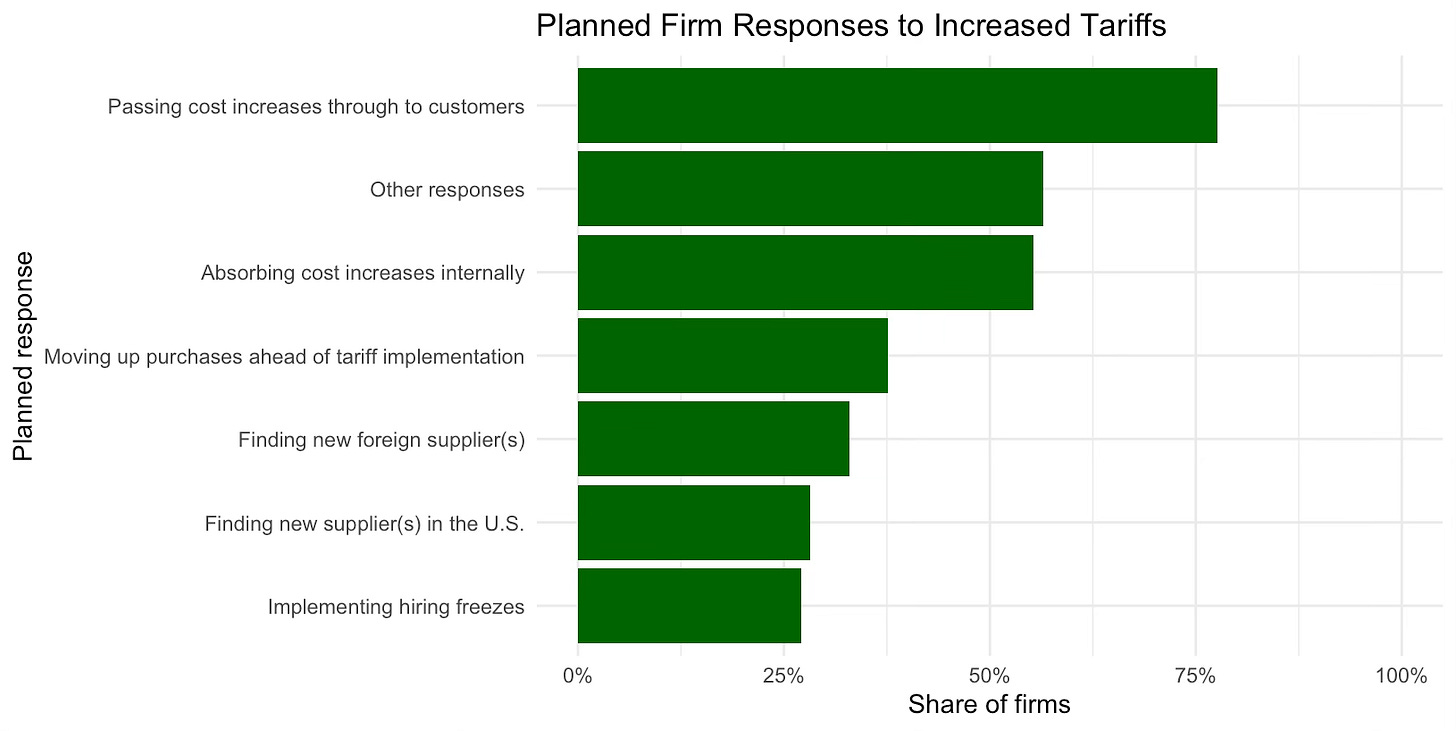

Among surveyed firms, planned responses to tariffs lean toward eating costs more than restructuring supply chains. 80% of companies anticipate raising prices and passing higher costs to consumers, while 56% plan to absorb the cost of tariffs internally. Only about 30% plan to pursue alternative foreign suppliers and even fewer intend to find domestic suppliers.

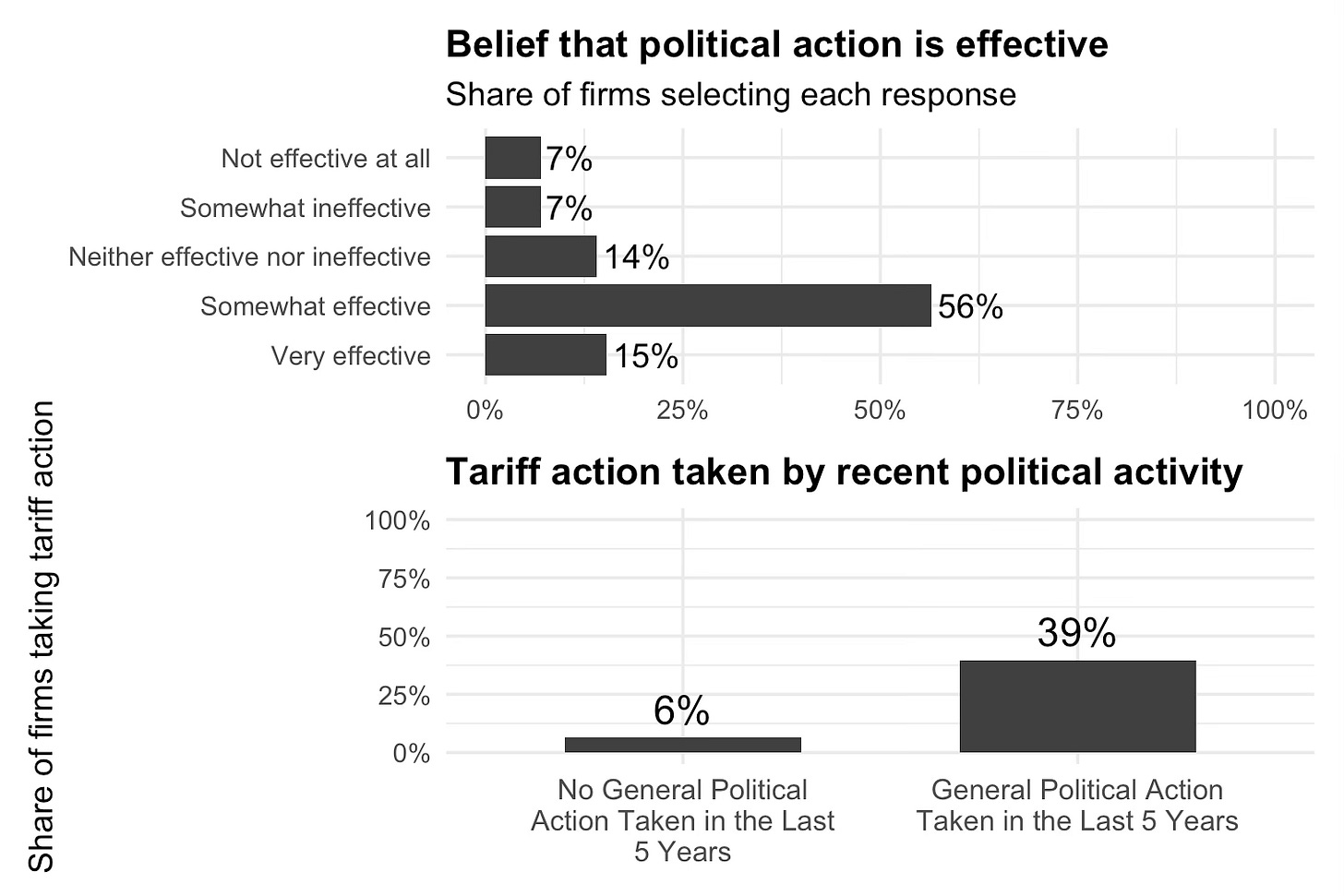

Most of the surveyed firms -- nearly 73% -- report believing in the effectiveness of political action to advance favorable policy, with 57% describing it as “somewhat effective” and 16% describing it as “very effective.” Despite this, very few firms have translated this belief into action towards tariff policy. Just 39% of politically active firms (those who have taken political action in the last 5 years) have acted specifically related to tariffs.

These initial results suggest that recent U.S. trade policy is a cause for concern for many businesses in Kansas and Missouri. U.S. tariffs raising the price of imports were the most concerning development among managers responding to the survey, with retaliatory tariffs creating obstacles for a more confined group of exporting industries. Rather than large-scale restructuring, firms primarily plan to respond with short term adjustments such as cost absorption and price increases. While most firms express confidence in the effectiveness of political action, relatively few have translated this belief into organized opposition or support for tariffs. In future iterations of this project, the Trade War Lab and its partners aim to expand data collection to include more firms from across the United States.

If you're a business manager and would like to contribute, please take our survey here.

The political action paradox here is the most striking finding. Firms believe lobbying works but arent actually lobbying, which suggests either collective action problems or rational calculation that someone else will do it. The 80% price pass-through plan versus 30% supply chain restructuring also reveals how tariffs work as a tax rather than industrial policy, most businesses just eat it and pass costs along instead of reshoring. The industry-specific data on retail (90% harmed) versus the overall 73% really shows who bears this unevenly.

The disconnect between believed political efficacy and action taken is very interesting to me. Great article!🙌