How Corporate Influence Reacts to U.S.–China Trade Policy

New Trade War Lab data sheds light on how American firms are lobbying the USTR.

As trade tensions between the U.S. and China escalate, tariffs, trade deals, and investment barriers have dominated headlines. However, a quieter but measurable trend has also been unfolding: a surge in corporate lobbying aimed at shaping U.S. trade relations. Data collected by the University of Kansas Trade War Lab provide meaningful insights on how the business community has reacted to the ongoing Trade War.

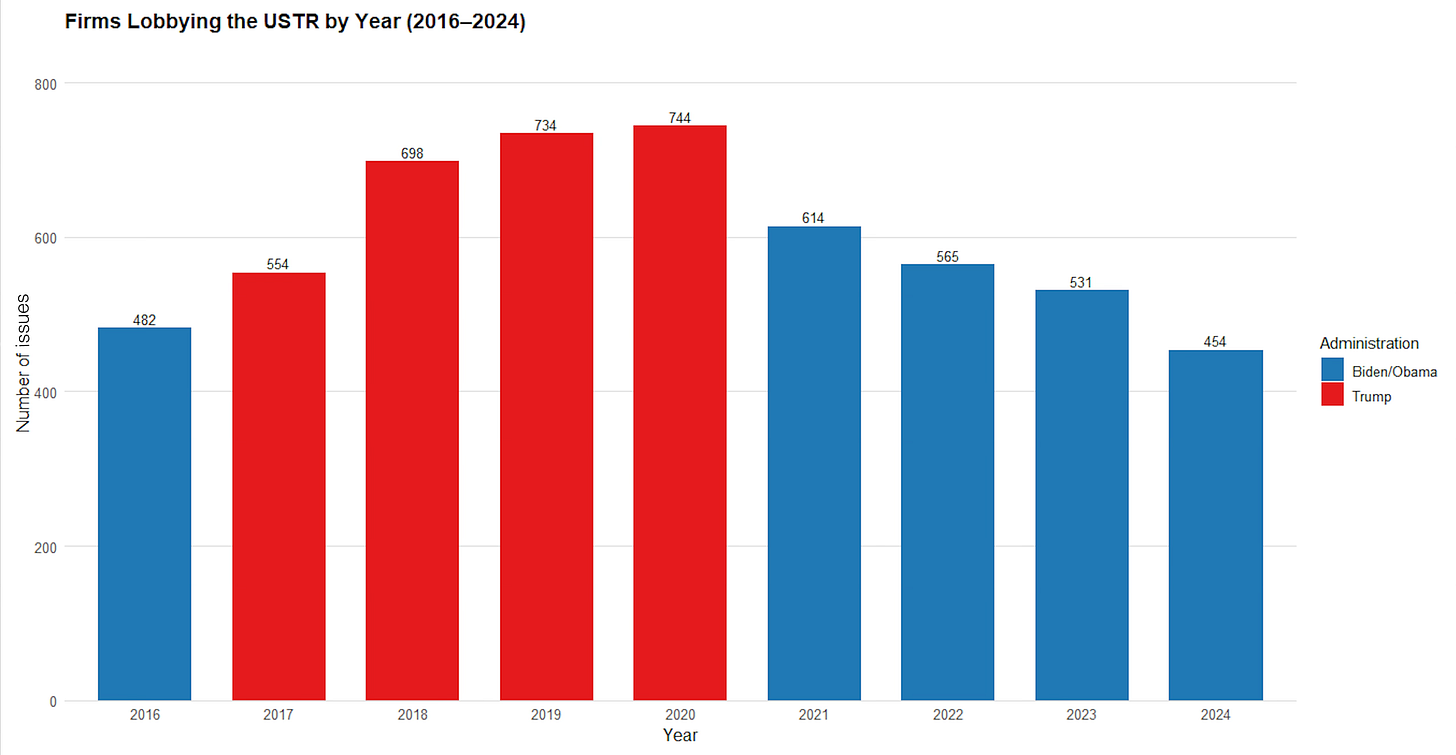

One of the clearest signals in the data is the growth in the number of companies lobbying the U.S. Trade Representative (USTR) over time.

In 2016, just 482 firms lobbied the USTR on trade issues. This number jumped to 698 in 2018, when the Trump administration imposed the first round of Section 232 and Section 301 tariffs on over $370 billion worth of Chinese goods. The total expenditure by firms on USTR lobbying shows a similar, if less dramatic, trend to the number of companies that lobbied. From 2016 to 2019 there was a 37.5% increase in expenditure, which lines up with the 54.4% increase in the number of firms lobbying USTR. Total expenditure peaked in 2019 at $1.1 billion, aligning with a spike in the total number of firms lobbying the USTR.

The data indicates that lobbying activity was at its highest amidst several key events between 2018 to 2020. As mentioned, the 2018 spike coincides with the imposition of Section 301 & 232 tariffs. Further, in 2019, tranche 3 of the Section 301 tariffs went into effect, increasing tariffs on some items by 10% to 25%. In January 2020, some of these taxes were modified when the U.S. and China agreed on the Phase one Trade Deal, which aimed to reduce the U.S. trade deficit with China and commit China to respecting the intellectual property of U.S. companies. The U.S. agreed to lift tariffs on goods such electronics, toys and clothing, and reduced tariffs on some items included in tranche 3 from 15% to 7.5%. Although this deal reduced levies on goods included in tranche 3, the original round of Section 232 and Section 301 tariffs signed in 2018 largely remained at 25%.

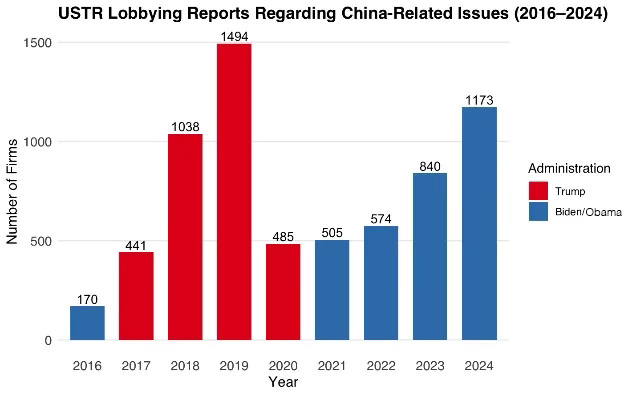

Lobbying isn’t just increasing in volume and expenditure; it’s becoming more China-focused. The Trade War Lab also tracks a “China issues” variable that counts lobbying reports referencing China-related concerns directed at any government entity among firms that lobbied the USTR.

While in 2020 China-related lobbying plummeted, likely due to the Phase One Trade Deal and COVID-19 pandemic, things started to pick up later during the midst of the Biden administration. Biden largely opted to keep Section 232 and 301 tariffs in place. The data reflects a major bump in China-related lobbying after the 2022 CHIPS and Science Act, which set aside $52 billion dollars for domestic chip manufacturing.

Prior to the CHIPS Act, the Biden Administration launched the Indo-Pacific Economic Framework for Prosperity (IPEF)., a cooperation initiative meant to bring nations in the Indo-Pacific region together to coordinate on multiple policy fronts. The IPEF is made up of 14 partner nations, which includes heavy hitters like Japan, and the Republic of Korea, but also emerging markets such as Vietnam and the Philippines. The IPEF, which came in the wake of President Trump’s swift exit from the Trans- Pacific Partnership, an Obama-era precursor to the IPEF, aimed to reestablish the U.S. as an economic partner in a region where China holds growing influence. The increase in lobbying in 2022 and 2023 may reflect corporate attempts to guide IPEF policy.

Lobbying activity has intensified in step with the U.S-China economic conflict, both in volume and focus. Trump’s return to office marked the return of his tariff-heavy trade policy, notably his “Liberation Day” tariffs that target a much larger group of countries than in his previous term. Trump’s approach furthers the increasing tendency of the executive branch to actively pick trade winners and losers, which creates incentives for companies to influence government decision making via lobbying, tilting the scales in their favor. Therefore, as the Federal Government increasingly puts weight on the scale of profits, lobbying is likely to become an increasingly important corporate strategy for navigating one of the most consequential trade rivalries of the 21st Century.