How Multinationals Managed the Trade War

Exit, voice, and loyalty in an era of rising protectionism.

Until the beginning of the trade war in 2018, the US-China relationship in the 21st Century had been defined by increasing trade liberalization. Conventional wisdom would suggest that multinational corporations (MNCs), which greatly benefit from free trade, should strongly advocate against the rising tariffs, but this has not been observed. Despite the vast majority of American companies opposing tariffs1 , many of them remain in place. Further, less than 2 percent of large firms voiced opposition to tariffs during the first trade war. What causes some MNCs to take political action and others to stay silent in the wake of increasing protectionism?

A recent paper by Rigao Liu (University of Kansas), Jack Zhang (University of Kansas), and Samantha Vortherms (University of California - Irvine) seeks to answer this question. The authors find that the trade war has faced so little opposition because differences between MNCs in their embeddedness in China and access to measures to avoid tariffs result in varying corporate strategies, meaning firms do not present a united front in opposing tariffs. The implications are that the politics of deglobalization do not mirror the politics of globalization; in other words, firms that successfully lobbied for trade liberalization will not necessarily do the same against increasing tariffs.

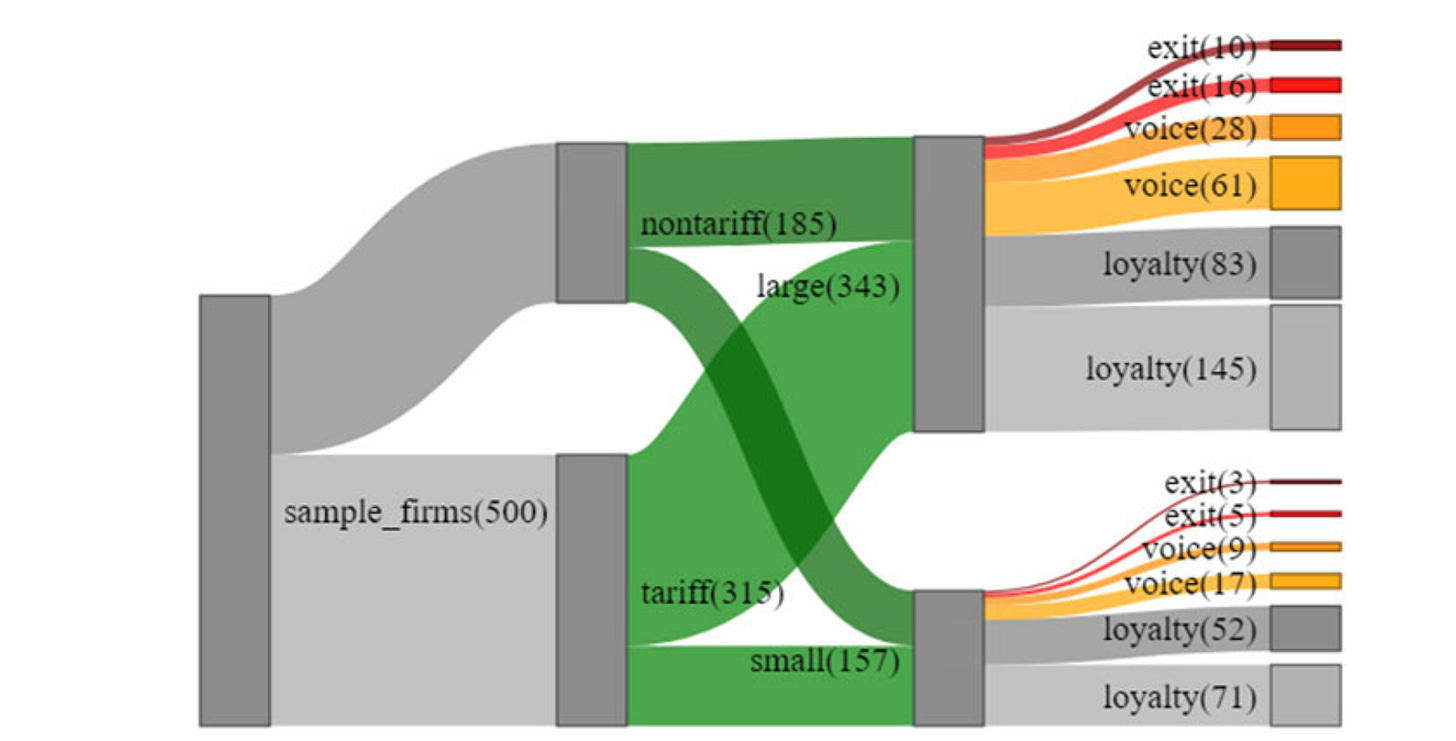

The researchers classify MNC responses to the trade war into one of three groups: exit, voice, and loyalty. Exit is defined as the subsidiary exiting the Chinese market, voice is defined as engaging in any political activity in the US, and loyalty is defined by a firm performing neither of the previous actions and remaining apolitical. The vast majority of the 500 MNCs studied responded with loyalty because of the fixed costs associated with the other two responses. Often, smaller firms lacked the means and larger firms lacked incentives due to their greater ability to switch strategies. For example, larger firms can more easily refocus their operations from foreign markets to Chinese consumers.

However, differences in behavior based on age, size, and joint venture (JV) status were observed. Older firms were more likely to voice opposition and less likely to exit and firms with JVs were less likely to exit or advocate against tariffs, supporting the authors’ original hypotheses. Larger firms were more likely to take political action, but there was no consistent effect of size on exit, partially supporting their original hypothesis. Meanwhile, the authors found no significant difference in responses between exporting firms and non-exporting firms, contrary to their original hypothesis. Just as firms differ by each of those factors, so does their response to the trade war. This helps explain the lack of a singular unified response, and therefore the continuation of tariffs.

In addition to the quantitative analysis, the authors performed four case studies. They selected companies based on their size and whether they were directly impacted by tariffs. The case studies exposed additional factors that the authors had previously disregarded, such as the ability for many larger firms to use Foreign Trade Zones or other global subsidiaries to avoid Chinese tariffs, and the ability to file for tariff exclusions. In addition, the case studies demonstrated differences in specific actions taken by firms based on size and the impact of tariffs. For example, the two large firms — Deere and Abbott — engaged in less public forms of voice because of the high political cost associated, while Twin City engaged in more public forms, because of the lower financial costs. Patterns like these continue to support the theory that actions by US MNCs span a range of strategies.

Overall, the research finds that US MNCs did not unite to oppose the trade war because of differences in firm-level factors, such as size, age, and JV status, that impact embeddedness in China. Most firms stayed silent on tariffs, with few voicing opposition and even fewer exiting China. The authors also found through case studies that there are even more possible responses to the new policies, opening up avenues for new research. All of this implies that the trade war will play out differently than trade liberalization of the past.

Lee, Jieun, and Iain Osgood. 2021. “Firms Fight Back: Production Networks and Corporate Opposition to the China Trade War.” In Geopolitics, Supply Chains, and International Relations in East Asia, edited by Etel Solingen, 153–172. Cambridge University Press.